Mikail Khalilov, Head of Digital Yelo Bank: "Thanks to Corezoid it takes 1 day to complete tasks, that previously needed 2-3 weeks"

|

|---|

| Mikail Khalilov, Head of Digital Yelo Bank |

Mikail, how did you start working for Yelo Bank?

I have been working at Yelo Bank (formerly known as Nikoil bank) for about 14 years, since my sophomore year at university. I started with an internship in IT: I changed printer cartridges, installed office programs, and did basic maintenance and technical support. At the same time, I began to study Core banking (marBasII), there was a space to apply my knowledge in mathematics and programming.

|

|---|

My efforts were noticed and I got a part-time job. In the first half of the day I studied, and in the second half of the day I worked. This is how my career began in Yelo Bank. From the IT department, I moved to the Finance department, where I was working with statistics, analytics and reporting. Then I managed the Project Office for a long time, where I was engaged in the development of the Bank's internal systems, such as Core banking, BPM, DMS, payment terminals, etc. Now I run the Digital Banking department.

How did you get interested in programming?

I have been fond of computers since childhood. When at High school I begged my parents during the summer vacation to buy me a personal computer. It was a classic "Corvette" computer.

|

|---|

| “Corvette” computer |

My first programs were drawing figures on the screen. As a student of the Faculty of Applied Mathematics at Baku State University, I learned to work with databases, studied the basics of programming. I like the book "Working with Oracle" by S.N.Smirnov a lot.

|

|---|

| S.N.Smirnov, “Working with Oracle” |

How did “Nikoil Bank” become “Yelo Bank”?

The market is developing rapidly, the generations of customers are changing. The new bank name “Yelo” is a changed spelling of the English word “Yellow”. The new name stands for the bright, vibrant, new approach to banking called “Brighter Banking”. We have adopted a new strategy focused on innovation and digital banking. This is the way the “Yelo Bank” brand was born.

What projects have you been working on lately?

Our first projects in Digital banking were channels for online customer service: Internet Banking for Legal Entities and Mobile Application for Individuals.

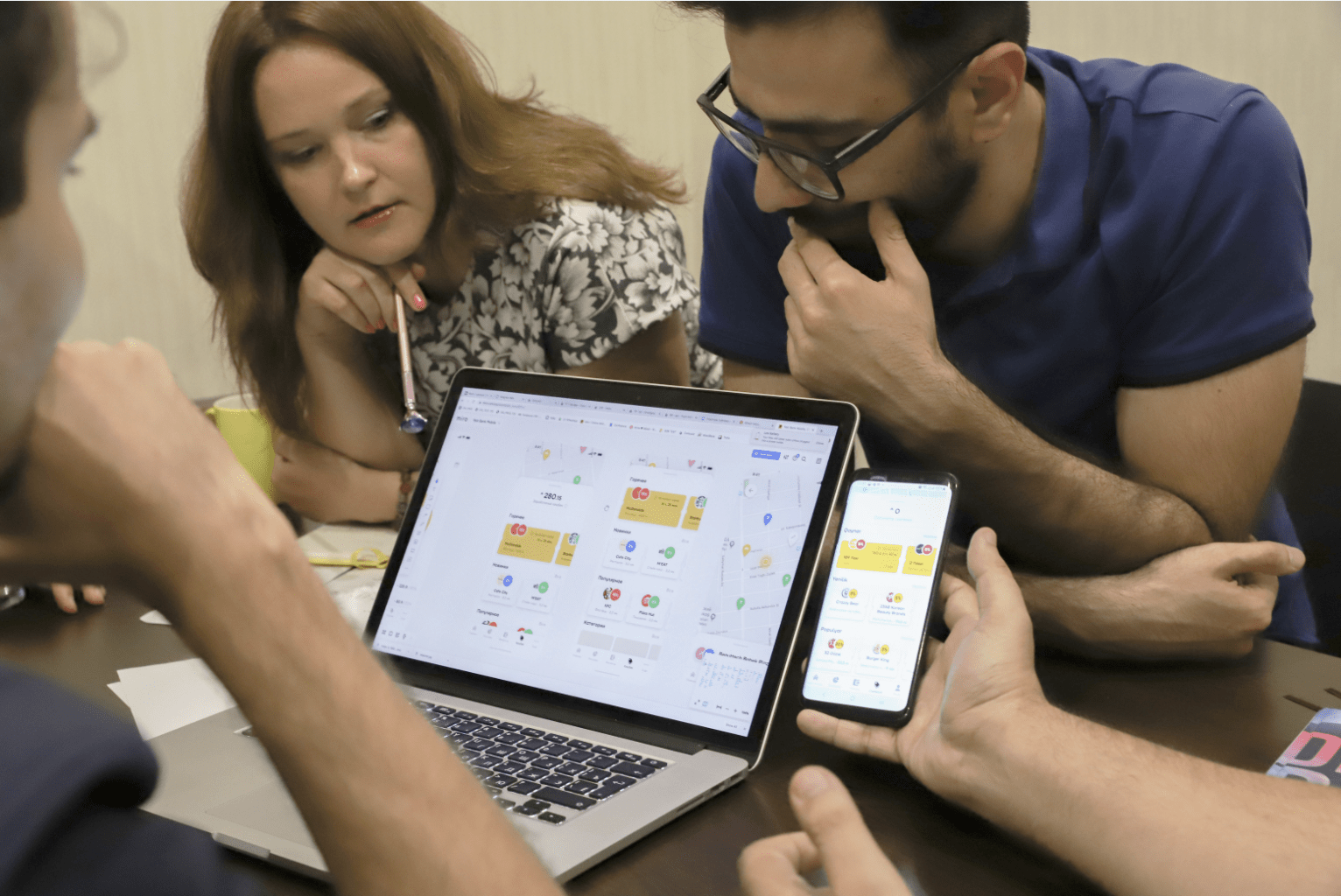

|

|---|

We started working on the mobile application with an external vendor, however for various reasons the project was not delivered on time. We’ve been working for a year, and half of the project was still not complete. We had to stop working with that company.

In early 2020, I took on the responsibility of starting a project from scratch with the goal of completing it in 6 months. I started working alone and I still had to put together a team. I need to thank the management and shareholders of the bank for putting trust in me.

|

|---|

I have assembled a team of 8 people. And in May 2020, both products were available for internal testing. I would like to note that this speed was achieved thanks to Corezoid technology, thanks to the work with Middleware company and, of course, my team, who put their heart and soul into the project.

I would like to note that this speed was achieved thanks to Corezoid technology, thanks to the work with Middleware company and, of course, my team, who put their heart and soul into the project.

At first, I was skeptical about Corezoid. While the team was shaping, I started to learn Corezoid in parallel, and even received the Corezoid developer certificate.

It turned out that Corezoid is a platform that allows our business analysts to build processes without hardcoding.

It turned out that Corezoid is a platform that allows our business analysts to build processes without hardcoding. Using Corezoid we built a flexible and agile architecture of the mobile banking application, so that front-end developers do not need to change anything in the interface, when they roll out a new release for the App store and Google play markets and don’t need to wait for the review.

Most of the functionality of the Yelo digital bank is managed by Corezoid.

Most of the functionality of the Yelo digital bank is managed by Corezoid. Corezoid tells the frontend of the mobile app, which form with which fields and icons must be displayed. As Middleware shared with us, such an approach is the best practice in many international companies. Here I want to say many thanks to Sergei Zamlianoy personally, who gave me this knowledge and understanding.

Can you give an example of a quick launch of a new feature?

Recently, during lunch with colleagues, we decided to add a new feature: request money from a friend. By the evening the same day, the functionality was ready. Now the client can request a certain amount from a friend, after which he will receive a push. It is enough to press the “Confirm” button, and the money is debited from the account. With our old approaches, it would take 2-3 weeks to develop such a feature.

With our old approaches, it would take 2-3 weeks to develop such a feature.

Just in a few months after the mobile app launch and without any advertising, 30% of all cardholders of the bank installed the mobile app. I think this is a good result.

|

|---|

Also, these days we are planning to launch chat bots in all popular messengers using the Sender platform from Middleware.

Also, these days we are planning to launch chat bots in all popular messengers using the Sender platform from Middleware.

What are your plans for the development of digital banking?

By the end of 2021, based on Corezoid we want to build mobile banking solution for Legal Entities. We also plan to launch web-based Internet banking for Individuals in August 2021. We plan to use the approach of dynamically resizing frontends to launch fast. There are also many other useful services that are being developed in parallel: insurance sales, online lending, quick money transfers, etc.

By the end of 2021, based on Corezoid we want to build mobile banking solution for Legal Entities.

We also continue to integrate our internal and external systems with Corezoid, for example, payment terminals, sms-push providers, etc.

What books, films, TV series could you recommend to our readers?

One of my favorite movies is “Revolver” with Jason Statham. This is a film about the path to enlightenment, about going beyond, overcoming fears. Also I advise you to watch the documentary "Samadhi".

|

|---|

| “Revolver” movie |

I like reading articles about successful businessmen, Japanese culture, about the approaches to work in Toyota company. The book “Lean Startup” (Eric Ries) helped me a lot. I can also recommend books by Robert Kiyosaki: “Rich Dad Poor Dad”, “Cash Flow Quadrant”.

|

|---|

| The Lean Startup, Eric Ries |