The dark side of APIs: how duplication slows the industry

The API concept was first described by Roy Fielding in 2000. Since then, millions of APIs have emerged worldwide. Over the past 16 years we have witnessed a real revolution. APIs opened the doors to the resources of companies. Companies were able to communicate with each other, to build new services and automate processes. However, the problem with APIs is that they inevitably give rise to hard-coding of duplicates. It is estimated that there are about 18.5 million programmers worldwide. Most of them code unnecessary duplications.

The most common culprit for duplication is companies' APIs. The more copies of the same code, the more time is wasted.

|

|---|

| Millions of talented people hard-coding THE SAME FUNCTIONALITY |

The FinTech world talks about APIs without stop. "We see that technically competent players on the market increasingly want to interact with banking services through APIs," says Bruce Wallace, COO of Silicon Valley Bank.

"If PayPal and Facebook did not bet on APIs, these companies would be dead already. Global resource sharing" that's what matters. Banks anywhere in the world, if they want to survive, should provide access to services via APIs," writes visionary author of Digital Bank, Chris Skinner.

APIs can be used as a growth point only by global players like Visa.

There is a contradiction: Skinner compares the global and the local. PayPal is a global company while a bank is a local one (and its APIs are local). Therefore developers are only local, meaning growth is held back. APIs can be used as a growth point only by global players like Visa.

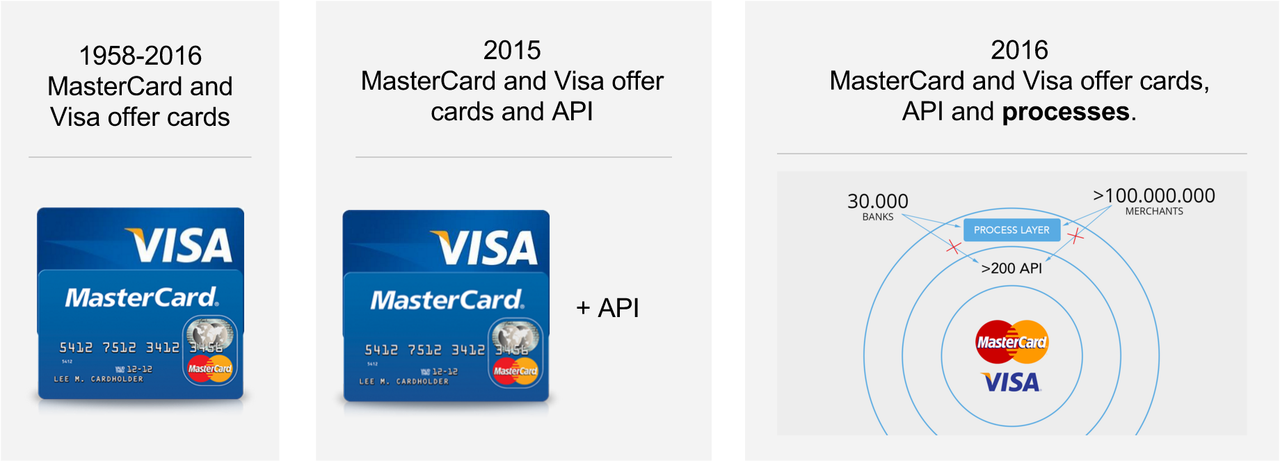

Visa and MasterCard reaffirmed their commitment to the idea of opening APIs. In 2015, MasterCard announced Open API Declaration. They were followed by Visa, which in February 2016 opened hundreds of APIs on Developer.visa.com.

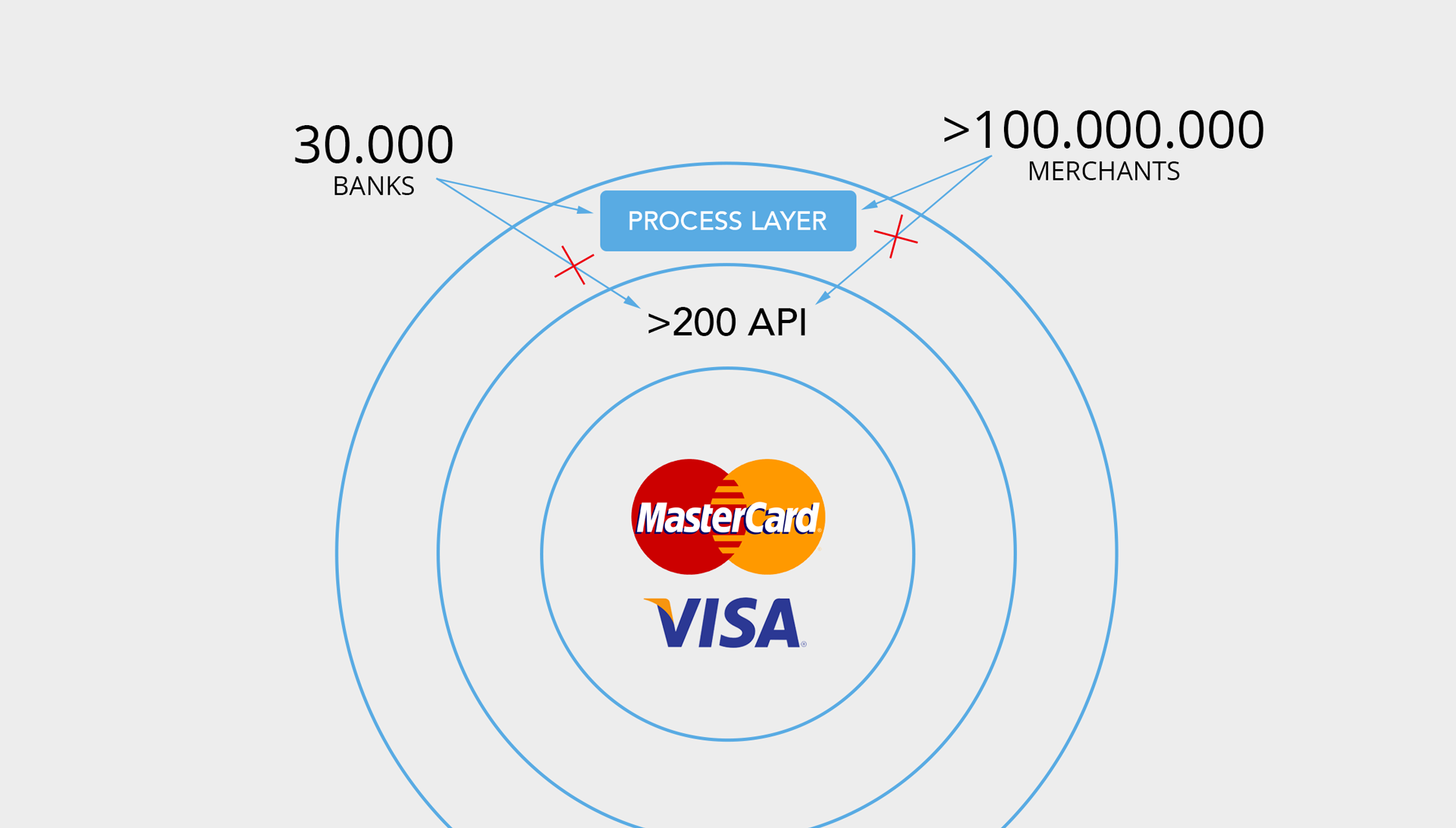

Visa and MasterCard have made APIs available for e-commerce, remittances, and geolocation. However, we do not see a queue of banks which could use APIs. Why?

From APIs to processes. The post-API era.

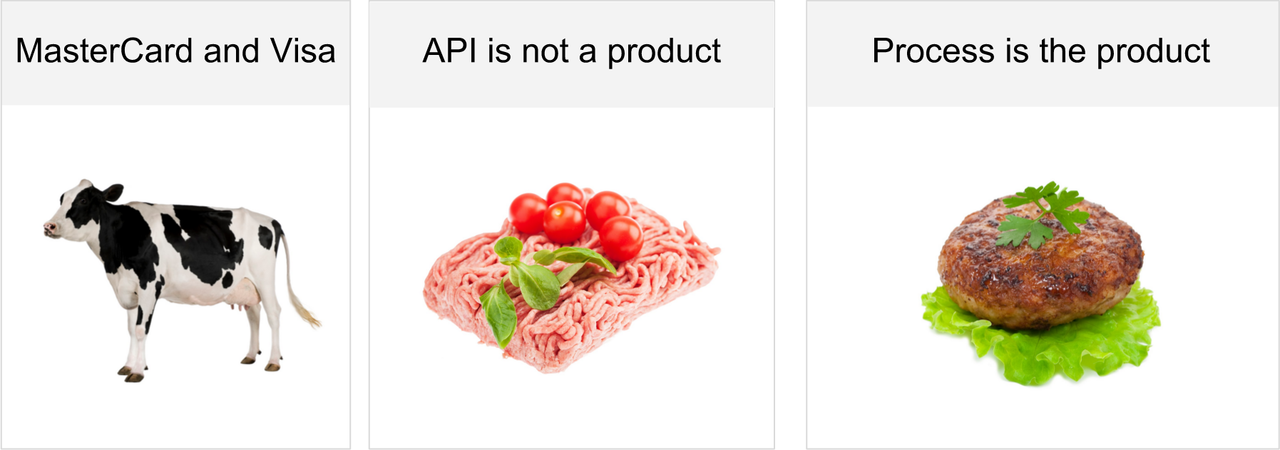

Banks are not IT companies. And an API is not a finished product. To make, for example, a Visa-based API p2p-transfer product, a bank needs hard-coding. Visa and MasterCard make banks do the same work ten thousand times.

There are about 100 million companies in the world. And more than 30000 banks. Programmers in these banks do almost the exact same work, creating 30000 identical online banks, 30000 mobile banking applications, and 30000 checkouts

|

|---|

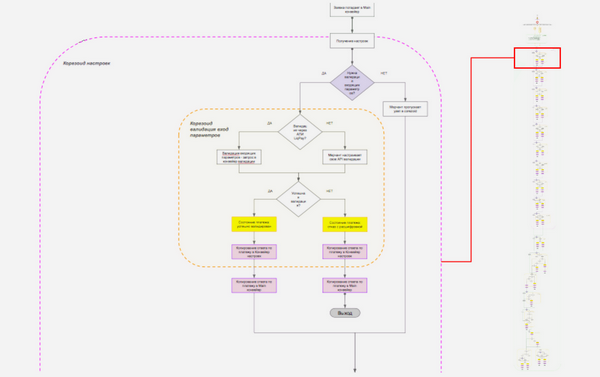

| Part of a 25-page remittance algorithm. |

Every bank creates hundreds of thousands of lines of code implementing their version of the algorithm. What for?

Banks want to get ready products of the same high level of usability as plastic cards from MasterCard and Visa. They don't want APIs .

All of these efforts are redundant. API availability is not the ultimate dream in software design. Banks do not invent cards, but simply pass them on to their customers.

What might the post-API era look like? We need a solution which can be easily scaled, copied, and changed that will not depend on a specific programming language.

The answer is processes. What is a process? A process is not just a set of data that is available through the API. A process is a description of all possible states of objects and rules of transitions between states. Hundreds and thousands of APIs may interact with each other in one process.

|

|---|

| API is not a product. Process is the product |

We need a paradigm shift. Companies need to open up and distribute ready processes, not APIs. "Welcome to the economy of processes," says Senior Vice President of Gartner Research, Peter Sondergaard. "Data themselves are inherently dead. The value is in processes [processes]. Algorithms determine the action".

|

|---|

| Visa and MasterCard need to distribute processes, not APIs |

Thanks to process layers, Visa and MasterCard are defragmenting banking

Banking is an ultra fragmented market. However, there is a part that Visa and MasterCard have long defragmented plastic cards. All banks issue identical Visa or MasterCard standard cards. However, despite the fact that card issuance technology in the world is defragmented, logistics remains fragmented. That is why today, Visa and MasterCard manage payment technologies and banks manage customer relationships.

Just as Visa and MasterCard defragmented plastic, they can defragment the rest of the banking system.

Digitization of plastic, which was mentioned in the previous article, and the transition from APIs to processes will change all that. Control of the customer relationship will move from banks to Visa and MasterCard. Just as Visa and MasterCard defragmented plastic, they can defragment the rest of the banking system, but it's not APIs that need to be distributed, but ready processes.

|

|---|

| Evolution: from cards to APIs and to processes |

Why are Visa and MasterCard able to do this? Because they are companies which were born global, and the market forced them to become IT companies. Banks have never been in such a position; they are inherently local companies.

When a banker is trying to tell you how he is struggling locally with global companies or works with Big Data, you can safely ignore him. Banking technologies are inevitably being globalized, and a local player physically cannot play against a global player.

As I have mentioned, there are 30000 banks in the world they are Visa and MasterCard clients. Of course, all banks issue the same plastic, but each at the same time fancies itself as a competitor to Google, creates applications, checkouts, antifraud, online banks and spends huge amounts of money on developers but in the end they all solve the same and absolutely useless tasks of increasing market fragmentation.

Transition from APIs to processes is very good news for banks

Therefore, the score is 30000 against 1 in favor of payment systems. Banking business defragmentation is mathematically inevitable.

Transition from API to process is really very good news for banks. Standardization and defragmentation will allow banks to receive finished IT products of equal high quality from Visa and MasterCard, wherever they are in the world. This will remove the sword of Damocles of trying to be an IT Company from above their heads. Instead, banks will be able to focus on their traditional competences.

Process layer is needed to transition to the post-API era

Thanks to process layers, companies can take finished products: online banking, p2p-transfers, e-commerce, etc - from the market places of Visa or MasterCard. All they will have to do is to adjust their processes in line with the requirements of local AML and compliance. Product launches in such a paradigm will happen as quickly as the client chooses, and not have to wait for programmers and contractors.

Visa replacing banks

Classic banking is being killed not by FinTech start-ups and even not by Bitcoin. This is already being done by Visa.

Imagine that a company which is engaged in money transfers wants to launch a service in 120 countries. The slow way is to announce a tender in each of these countries, select IT vendors, spend years and have a poorly controlled zoo with copies of same service in different programming languages. The quick way is to use a process layer where, as part of the cloud digital core, dozens of its own APIs are linked to APIs of partner banks. In such a paradigm, created processes can be copied all over the world, adding necessary local settings. Such a smart company can launch in new countries not in years but in a few months, adjusting for local procedural matters such as compliance.

An online bank, for example, can be imagined as a set of ready processes. An online bank must become a standard product like a Visa or MasterCard plastic card.

The fundamental technical problem of commercial banks is the localness of the banking business.

The existence of process layers allows any bank anywhere in the world to take ready to use core-processes out of the box, which have tens of thousands of APIs from the FinTech world under the hood.

To summarize, it can be said that the fundamental technological problem of commercial banks is the localness of the banking business. Banks can only grow to particular geographical boundaries, so sooner or later most banking technologies will be commoditized and passed to the control of global payment systems. Today, a practical banker needs to think how, and in what form, he will exist in the medium and long term.