"Banks are geniuses of FRAGMENTATION" – Alexander Vityaz, Middleware Founder&CEO

The desire of banks to digitize at any cost often leads to the processes becoming even more complex and clumsy. Ex-deputy Chairman of the board of PrivatBank, founder of Middleware Inc. Alexander Vityaz calls this effect "fragmentation." SME Banking Club discussed with Alexander the main problems of Internet banking both in Ukraine and globally, as well as the competition of the banks, fintech and telecom companies.

|

|---|

BC: Why the majority of the banks have bad Internet banking?

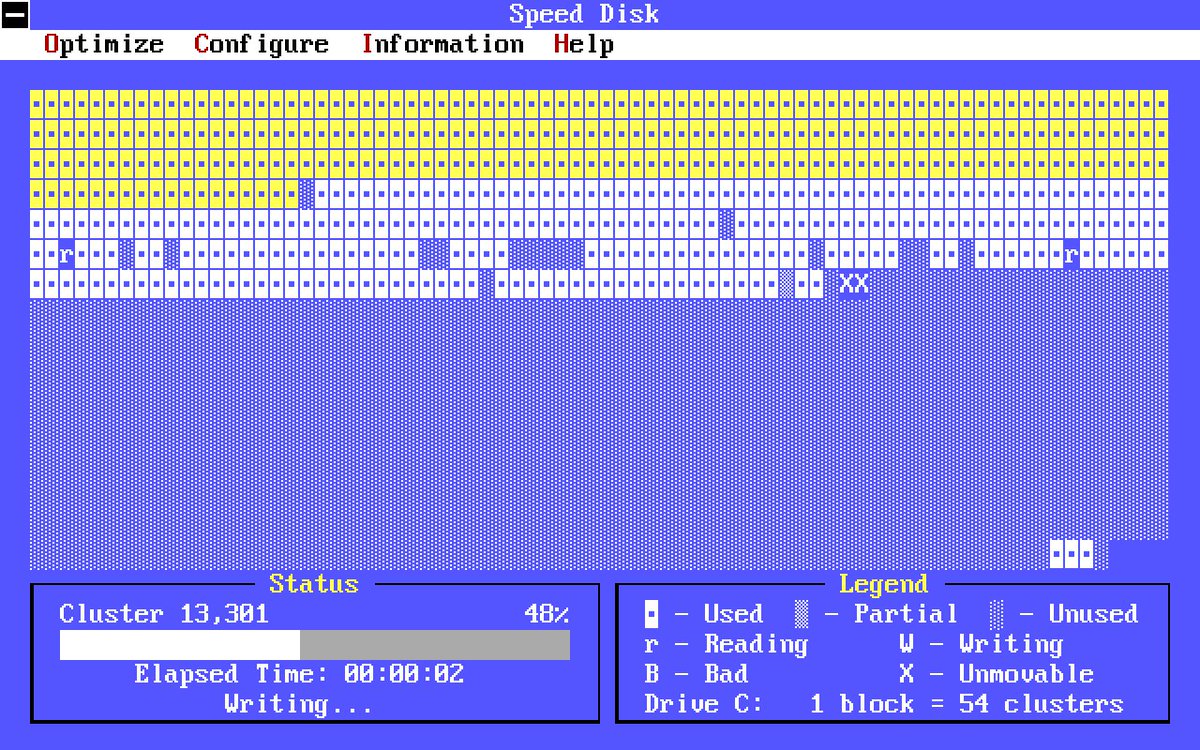

A.V. Everything is bad with the banks, not just Internet banking. Internet banking is a showcase, everyone sees it, it is an easy target for critique. However, the main problem is rooted deeply inside the company. And it is called FRAGMENTATION. We work with hundreds of companies and once we realized that the source of problems for everyone is always the same – fragmentation of everything. Fragmentation of decision making, management, technologies... Everything that can be fragmented, companies born "on the ground" immediately do fragment. Do you want to pretend to be technical-savvy? Announce a tender for the purchase / development of software – and you are guaranteed to become even more fragmented. Banks are factories, they are geniuses of fragmentation! Fragmentation as a black hole devours energy and organization time.

BC: What about the quality of Internet banking outside of Ukraine? Which companies are doing good?

A.V. Those companies are doing good, that don’t have internet banking at all :-) For example, the brex.com project, which offers corporate credit cards for IT companies, does not have a mobile application at all. And everyone is happy.

BC: What can be done to improve the situation?

A.V. The answer is “simple”. In order to improve the situation you need to fight fragmentation and become curious :-) These are super-hard and unconventional challenges.

BC. Which approach is better: to hire external vendors, or create your own digital department?

A.V. Both options are wrong. Both increase fragmentation. It is necessary to grow digital competencies in the business itself. Competence, culture and intelligence can’t be outsourced. The development of the mobile application and the digital core of the company is an ongoing process. Don’t think you can buy a “turnkey” solution and become “digital”. It is the sure way to be lagging behind. Outsourcers can and should be involved to do some background work, but if you want to be a leader, you should grow the core-competencies inside the company.

BC. Is it possible to train all the business units in the bank to “think digital”? So that accounting department and digital stuff were not like “separate universes”?

A.V. This is a very clear example of inherited fragmentation within an organization. The main job of top managers is to defragment IQ and TQ (tech quotient) in the company and force compliance / accounting / HR, etc. speak the same language with business and IT. I repeat once again: this is very difficult and creative work. No external consultants can do this job for you.

BC. Is it more difficult to create good Internet bank for individuals, entrepreneurs, medium or large businesses?

A.V. If you really want to do this, and not just imitate innovation or hide behind hackathons and conferences, then everything is equally complicated, everything requires time, competence, entrepreneurial energy and... soul.

BC. For a long time banks offered to business only Internet-bank tied to a specific PC. Is it still relevant?

A.V. This concept is changing thanks to the roles management principles. For example, top managers do not make payments, and they are given only the “view role” on a smartphone. Some clients also want to have such a role model for security reasons. So far this is the easiest and most effective way of protection through isolation.

BC. How are the needs of all these audiences changing?

A.V. Smartphones are creating the main pressure. All other factors are derived from the developing super mobility of staff and customers.

BC. How does the perfect Internet bank for small businesses look like?

A.V. The best Internet bank for SMEs still remains to be invented. So far, all that we can observe is an improvement of what was done in the past. The best Internet bank would be simplified to the point, when it becomes almost invisible. Nobody was born with the dream of sending payments and paying taxes :-)

BC. Why does online lending still remain a hard task for bankers? Is it really impossible to automate the loan application process?

A.V. Sure, it can be automated. However, someone needs to “defragment” the business process initially. If you are not able to issue loans in real time “on the land”, how are you going to make it in the digital world? Fintech companies are the pace makers here, and classic bankers are following.

BC. Which services in the future will be provided by the banks, and which ones will be offered by faster and more digital players (fintech, mobile operators)?

A.V. The banks will have everything they want. However, the huge fragmentation does not allow banks to be fast and curious. Therefore, on the one hand, biting off market share by young and fast companies is inevitable, but, on the other hand, the market is growing. There will be enough space both for the established and the new players.

As for mobile operators, they do not belong to the tribe of technology companies. These are service companies that use purchased equipment and software in their work. This makes telcos even slower than banks. Multiply this by the lack of expertise in lending, external funding of accounts (from bank accounts), the lack of a vertical integrator (for banks this is Visa and Mastercard) – and it turns out that it is easier for an operator to buy a bank than to become one.

BC: What is more important for the successful development in the financial market today: experience in financial services, or experience in IT?

A.V. Both components are necessary but not sufficient. Add here an intent to defragment the company, curiosity and you will get a chance (not to be confused with a guarantee :-) to grow. Companies will have to become elastic and acquire moderate ADHD (Attention Deficit Hyperactivity Disorder). Leonard Mlodinov talks about this very well in his book “Elastic. Flexible thinking in a constantly changing world”: “What if these features of ADHD correlate with positive stuff: productivity, sense of purpose, and the ability to quickly produce ideas?”

BC: Who could be a role model for the online customer service?

A.V. PUBG :-).

VS: Internet banking looks like an ideal platform for the development of ecosystems of banks. But does it make sense in terms of money? Or is this a story only about loyalty?

A.V. It is a wrong impression :-) The story about the platforms is a myth. Ecosystem is a game for one. “Super applications” can be only done by super-banks. For niche / medium / small players such an approach would mean the same fatal loss of focus and fragmentation. While banks are pushing hard to give birth to 24,000 “the best mobile applications in the world” and make them “ecosystems,” brex.com can issue credit (!) Corporate cards online without a personal meeting with a client.

|

|---|