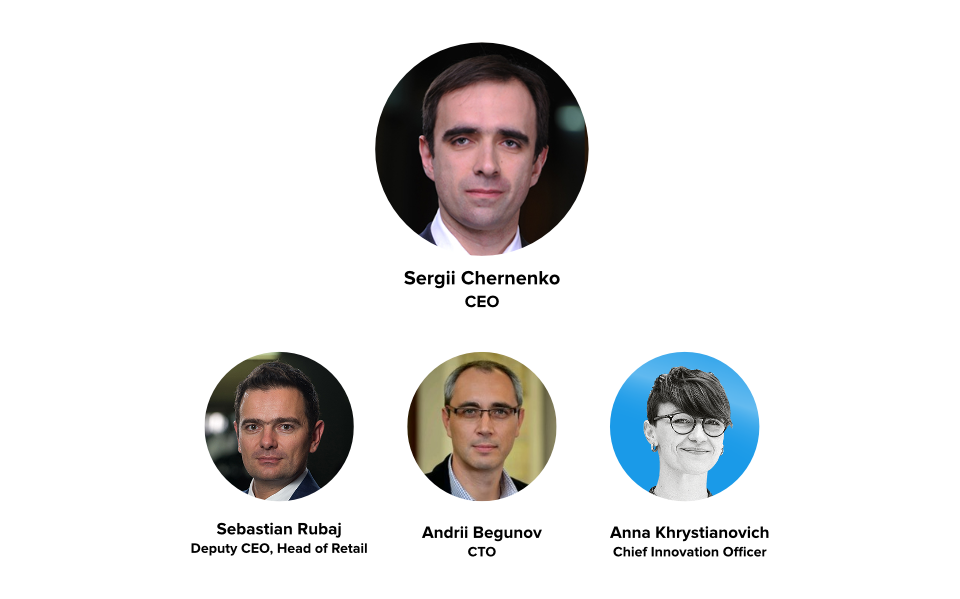

Anna Khrystianovich, PUMB bank: “Corezoid allowed us to launch 3 times more projects”

|

|---|

| Anna Khrystianovych, Chief Innovation Officer, PUMB bank |

How did you start your “digital transformation” journey in PUMB bank?

We started developing technical skill-set a couple of years ago in the bank. In a course of the last 4 years we implemented several complicated technological projects.

First of all, this is the merger of the two banks in the shortest possible time - FUIB and Renaissance Credit, with the subsequent change in the business model. We started this project during the crisis in the country, deciding to use a period of reduced business activity in the market to implement a project that required complex technological and managerial decisions. During the implementation of this project, we realized how important it is to be able to manage change and how important the technological component in this process is. Our IT architecture at the time was not ready for such challenges.

We started looking for an opportunity to change the IT architecture and realized that we need a reliable partner along the way. Middleware has become such a “Technology partner”, which helps us in creating “Digital core” based on Corezoid Process Engine technology.

Thanks to Corezoid, not only IT specialists, but also representatives of the bank's business units can very quickly and independently change business processes and experiment with new ideas, which was previously impossible. In this case, the IT department of the bank, instead of writing code, can focus on developing the required number of APIs. This can significantly reduce the waiting line for IT development and, accordingly, accelerate the introduction of new products and services to the market. This gave us the opportunity to increase the number of implemented projects by 3 times compared with the previous year. As an example, we quickly launched dozens of banking services in the Viber messenger, and adding functionality to the Telegram messenger took only two days.

It is important to understand that a significant component of any changes is the possibility to conduct experiments. Usually you need at least 1 year to conduct any experiment in the bank. The cost of the experiment is high, and the risk of making a mistake is also very high.

The same situation we had with the projects. Our projects used to last for 2-3 years on average. By the second year of implementation, the project may already lose its relevance.

That is why the culture of experiments, the culture of finding a solution that will be most interesting to the client, has never been formed in the banking sector. But we at FUIB we decided not to give up. We allowed ourselves an experiment, gave ourselves the right to make mistakes. And this approach worked.

What were the main challenges that you faced?

The main problems were associated with total "complexity." FUIB is a bank with history, we have existed since 1991. During this time, we accumulated "complexity." And you need to understand that this "complexity" appeared not in any one place, locally in one of the IT systems. Complexity lay in people, business processes, products.

| People | Processes | IT Systems |

|---|---|---|

|

|

|

| We think complex | We build complex processes | For complex processes we support complex IT-systems |

People in the banking industry think complex. We have complex products, we have complex processes.

As a result, these complex processes turn into products that are not very convenient for customers. Often, the illusion is created that if we buy another magic software, we will be able to set up another complicated process. But in the end, we only spawn the zoo of IT systems. In our case, there were more than 80 of IT systems. In such a situation, any change in the product touches several pieces of software at once and the changes may drag on for years.

What were your main areas of focus in a course of “digital transformation”?

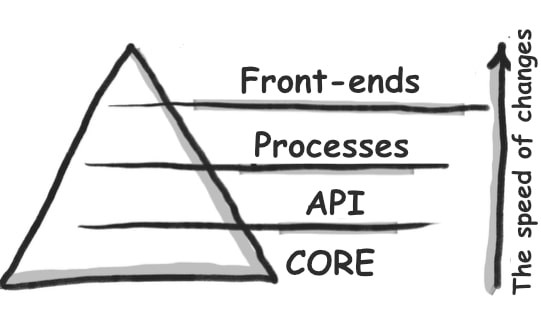

We started digital transformation with 3 focus points: IT systems, people, processes. At first, we understood that we needed to change the IT architecture. We draw a pyramid-scheme, that you can see below.

| IT Systems |

|---|

|

| From siloed software to dividing complexity into layers |

This is a high-level representation of how we divide the “complexity” into layers. This pyramid is known by every person in the bank.

All our 80 software systems are “monolithic” systems, meanwhile we wanted to be able to connect any front-end to any API, and do it quickly.

The top layer represents our front-end, points of contact. This is what our client sees: messengers, Internet bank, mobile applications, front-end in branches, etc.

The next layer is the “process layer” that works with Corezoid. Next is the API layer. And next are core systems: these are bank accounting systems, in which things do not change as often as in the upper layers. We see that from the bottom up, the frequency and demand for change from the business units is growing. The higher the layer in the pyramid, the higher the dynamics of change. Front-ends can be changed easily, quickly and cheaply. Making changes on the bottom layer in core systems is long and expensive.

All that concerns the upper 3 layers (front-ends, process layer on Corezoid, APIs) - all this we do internally in the bank. The needs of the lower layer are satisfied with external vendors with appropriate competencies.

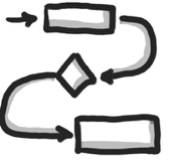

However, when we talk about digital transformation, it is not only about technology. It is about restructuring of processes and relationships within the company. We began to create multi-functional teams consisting of IT specialists, marketers, designers, product-owners and specialists from other departments. We changed the approach to the management of such cross-functional teams. Gradually we moved away from a sequential development cycle (waterfall) to scrum. Now we have cross-functional teams that create products based on Corezoid.

We do our best to design processes in such a way that they could be re-used. This approach gave a huge increase in speed. Previously, for example, we sold a deposit in the branches, and it was one system, and the sale of a deposit through a mobile application was operated by another system. And if it was necessary to make a change in the process of selling the deposit, then we did this work twice.

Now we only need to change the business process in one place. The process logic assembled on Corezoid can be connected to any front-end, where this service is offered to clients.

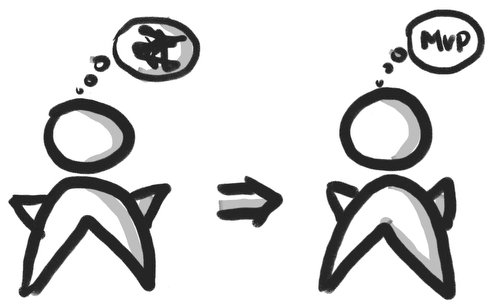

At the same time, we carried out a great work with employees inside the bank. We began thinking in terms of “MVPs” (minimum viable product). We taught the bank to stop creating “spaceships” and begin to train on small products, small services, build prototypes and launch them, work with clients, see if customers like services or not, and then scale gradually.

| From complex thinking to thinking in terms of "MVP" |

|---|

|

Such an approach allowed us at the very beginning of the service launch to receive feedback from customers. Sometimes, after such initial feedback, we realized that the product did not shoot the stars and we closed it.

Often after the launch we received feedback that allowed us to develop the product in a way that we did not expect at the beginning of the journey.

Who were the bank employees involved in the “digital transformation”?

We worked in full swing at all levels. The chairman of the board and all the top managers personally participated in the project. Start thinking in terms of simple products was a big challenge for us.

Things became easier when using Corezoid, we were able to come up with MVPs, run prototypes, learn from customer feedback, and improve with constant iterations. Corezoid allows you to customize and assemble processes by business teams. When someone from the team started to achieve remarkable results, it was very inspiring for all the people around. Digital transformation for PUMB became a true mindshift. Today we already have well-coordinated teams that are constantly experimenting, creating cool services.

For example, here is a link to our Viber-bank. This is a project that we did not describe in detail, did not plan, did not write the “Technical specifications”. Just 3 people on the business side, having learned Corezoid, started trying to work with messengers. Were already had some APIs available, the team quickly connected those AIPs, and began to add various services to the chat bot: checking account balance, transaction notifications, selling insurance. Now more than 130,000 clients use the bot.

|

|---|

We also launched a new mobile app. But our biggest pride is not so much the mobile app itself, as the realization that we have learned how to issue new releases every week. We were able to get feedback from the clients, and quickly implement it in the next release.

|

|---|

When you start big projects on “digital transformation”, you can’t think about any local improvement. If you have a separate department, which will be super-digital, and the old organization will live as before, it will not work.

It is important, albeit in small steps, but to change the whole organization. If everyone does not begin to think in terms of experiments, MVPs, then the necessary for transformation speed will not be achieved.

This is our story. I wish you all success. Thank you!

This article is based on the presentation by Anna Khristyanovich at the “Ukrainian Marketing Forum” on April 17, 2019 in the section on “Digital Transformation”, organized by D2.digital company.

| PUMB Digital Transformation leaders |

|---|

|