Chatbot for VUSO insurance company, based on Corezoid

Problem

The insurance market has a high level of competition, and each Insurance Company (IC) strives to increase its market share. Since insurance services among competitors slightly differ, the main advantages of the IC to win the race are brand recognition, reputation, and progressiveness. Here is the reason why every insurance company strongly pays attention to the website, offices, presentability of clients’ portfolios, feedbacks, as well as the introduction of the innovations in the insurance business. Nowadays, market demands constant skills enhancement, usability, and firm web design.

Another problem of any client-oriented company is the process of communication. How to provide existing clients gently with the information support, and encourage their repeated request? Now, what about the bank, insurance, foreign school call-centre operators? All these calls are being so annoying, both for potential clients and workers indeed. Why? Maybe, this process played out long time ago.

Supporting clients in messengers is standard operating procedure nowadays. Our team has moved forward and we are going to tell you how to bring it to the next level. The answer is to provide each client with a personal insurance agent on his mobile phone in 24/7 mode.

|

|---|

Solution

Insurance Bot is the solution. Insurance Bot is the unique chatbot, which works as an insurance agent with the ability to lead the client through the sales funnel without the involvement of the IC manager. The chatbot is available around the clock, around Ukraine from any device without installing any specific applications. Using insurance chatbot requires the registration in the popular messenger and the access to the Internet.

|

|---|

Such kind of innovation will definitely enhance the image of the company, demonstrate its status and concern for customers. Furthermore, two-way communication channel will easily solve the problem of importunity. With the help of chatbot, it is easy to inform customers about new products, special offers and encourage them to re-apply. It is no longer necessary to have operators who try to call a lead, spend time and money on endless dialling, and as a result: the lead is angry with the mere fact of frequent calls, next step - he/she starts ignoring calls and finally disappears. Messages are good because the lead reads them when it is convenient, but which scenario will cause more conversion?

Scenario 1. The lead reads the message with commercials like “Don’t forget to extend your Third Party Liability insurance! Or we can do it for you!” He needs to open an insurance company website, look through current prices, call back an insurance agent, and supposedly extend his policy of assurance. In case the due date of the insurance is far from actual, the lead simply deletes the message.

Scenario 2. The lead receives a message with the text “Don’t forget to extend your Third Party Liability insurance! Or we can do it for you!”. After reading it, he has to choose: to calculate the cost of extending the policy, renew the policy, or recall later. As soon as the lead chooses the best option, he will immediately get positive feedback. If the lead is not interested in any of the offers, he won’t close the message but click on “remind me later”.

The second scenario has two advantages at once:

..It is not intrusive if the user will be bothered by the notifications from a specific insurance company - he simply blocks the bot's ability to send messages. ..Answering, the lead doesn’t need to call, write, or spend money, but just click on one of the options.

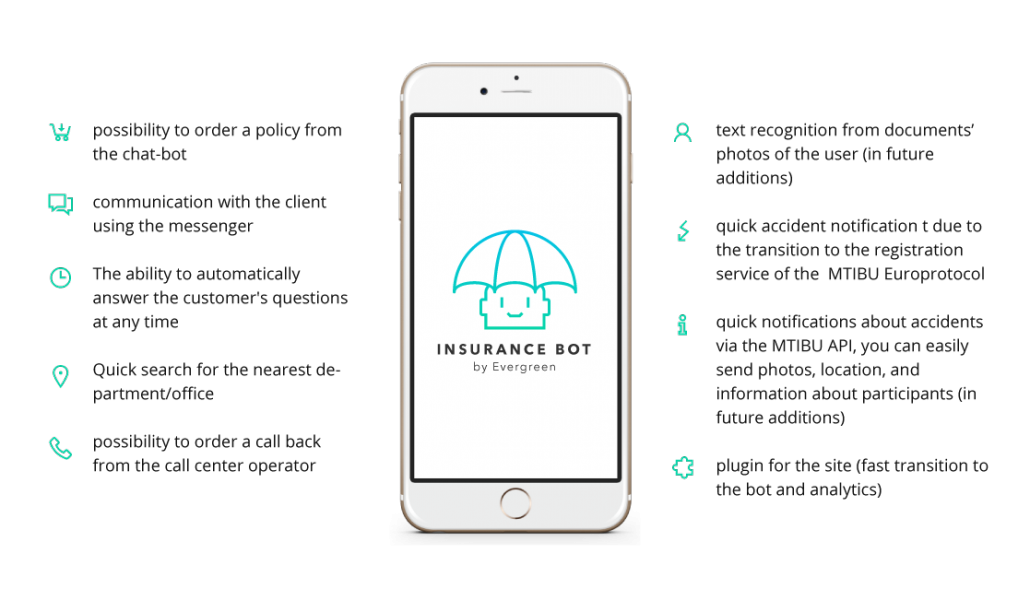

Unique functions of the Insurance Bot

|

|---|

Tech background of the Insurance Bot

|

|---|

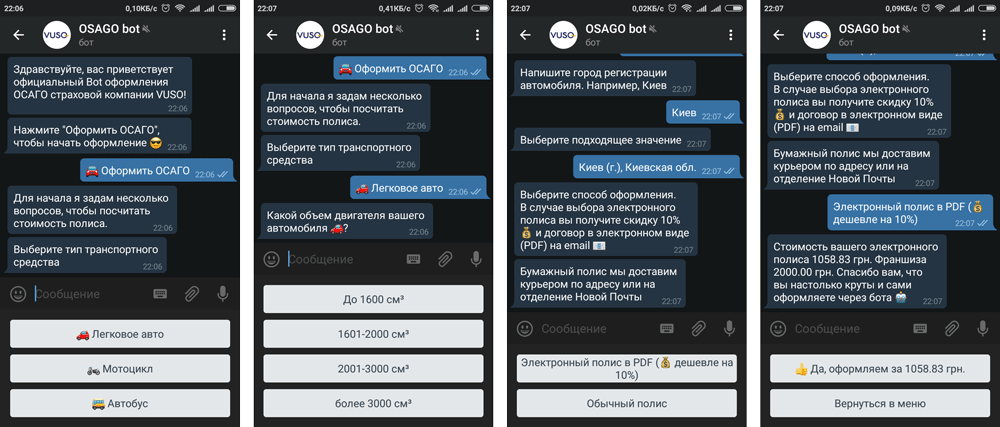

The physical appearance of the Insurance Bot

|

|---|

The results of the VUSO first Insurance Bot launching

|

|---|

VUSO is known in the insurance market as an innovative insurance company, which strives first to introduce and apply new technologies to its activities.

The company conducted marketing analysis and pointed out that most of their consumers are modern and active people who spend most of their time with the smartphone in their hands.

In February 2018 insurance company VUSO started selling the Electronic Third Party Liability insurance policy, and the drivers finally had the opportunity to finalise the policy remotely.

To give customers the opportunity to formalize the policy of Third Party Liability insurance from the phone became a primary task. Chatbot which works on the messenger platform easily provided the solution.

The Insurance Chatbot helps drivers make away with the waste of time and wait when the weekend ends - the formalization of the Electronic Insurance Policy is available 24/7. VUSO clients have the insurance company in their smartphones. As the policy is valid immediately from the moment of the registration, a customer doesn’t need a paper version of the insurance.

|

|---|

At the end of the process, we’ve got a very productive tool which compiles a full TPL insurance policy only in seven minutes with the ability to pay it right away. The bot is available in messenger in Ukrainian and Russian. During the first month after launching, Chatbot was able to quadruple the conversion among users from mobile phones. This activity proves once again that people will always give preference to mobility and convenience. The Chatbot is ready to cope with the tasks of any complexity, the question is only in price, and the skills of the development team.

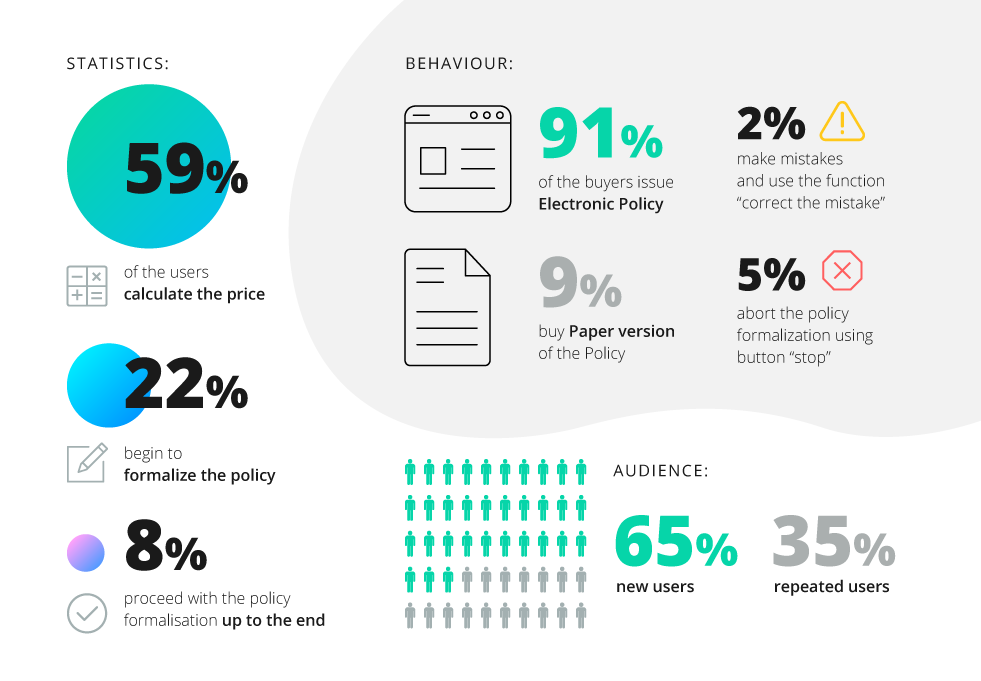

Based on the results of the first month of operation of the Third Party Liability insurance bot, we have the following statistics.

|

|---|

We see that the majority of users calculate the price of their insurance, and only 22% begin to formalize the policy. This is normal tendency in the service sector - many people research the prices of different companies before making their final choice.

But the only difference is that the bot can simultaneously calculate a huge number of requests, and this does not affect its costs. Let’s look at this question from the other side. You pay for the bot once before the development, or with a fixed monthly subscription cost. But do you know how many operators you will need to calculate policies with such operativity, without paying attention to the fact that only 22% will decide to issue the policy, and 8% will buy it?

The fact that 91% of policies issued through a bot - being more precise, Electronic Policies, gives an insight, that the innovative product needs an innovative sales channel. And as trust in Electronic Policies increases, there will be more and more people willing to buy them.

Finally, 35% of the refunds mean that after calculating the price, having tried to start the docs formulation, and having familiarized with the bot - people open it again to finish the process, or show the bot to friends.

This experience is only the beginning. VUSO Insurance Bot has been working only for one month. Well, and Electronic Policies are a wonder for people. When drives are sure that they don’t need to issue paper version of the policy, and they can buy an insurance sitting in the car and it will be valid, Insurance Bot won’t be a product innovation anymore but the necessity.