Julio Gómez, CEO Blue Finance Ibérica: “We find Corezoid processing power a game-changer”

Scandinavian flat hierarchy and the high level of trust given to Blue Finance employees were decisive for Julio Gómez to decide on joining the company and its ambitious opening to Spain. Settled in Finland for the last ten years, Julio was contacted by Lauri Lehtonen (Founder & CEO at Blue Finance) who proposed him to conduct the market research on the risks and opportunities for the fintech business in Spain. In this era where leadership and entrepreneurship are at the core of the debate, Julio showed not only both qualities but also a great degree of objectivity. Thus, he was offered to lead operations for the firm´s Spanish project, which meant setting up Blue Finance Ibérica from scratch and running the daily operations bottom-up. We all acknowledge successful founders can through their vision shape the market, don't we?

|

|---|

| Julio Gómez, CEO Blue Finance Ibérica |

– What were the big goals that the shareholders (or you personally) set in front of you when you joined the team?

– I was contacted by Lauri Lehtonen (Founder & CEO at Blue Finance), who was evaluating entering the Spanish market at the time, and he wanted to know the opportunities and challenges this market had to offer. I agreed with him to conduct a market research. Lauri appreciated my objectivity and offered me to lead operations for the Spanish project, which meant setting up the Spanish organisation from scratch and running the daily operations bottom-up.

– What was your impression after the first month working at Blue Finance?

– One thing that catched my attention was the level of trust and flat hierarchy at Blue Finance. That in itself should not surprise me at all because I have spent the last ten years living in Finland working in Scandinavian organisations. I was comfortable, I felt like at home from day one. I had a great degree of freedom.

– What were the big goals that the shareholders (or you personally) set in front of you?

– Blue Finance had projected an ambitious strategy that involved launching several markets in a few years. We looked at different opportunities around the globe and decided that Europe was still attractive with great chances yet to explore. Last year we launched operations in Denmark, this year in Spain and we are planning to establish another two markets towards the end of 2020.

There are very successful cases in the Fintech industry for the Spanish market such as WIZINK, VIVUS, Moneyman, Fintonic, etc. Blue Finance is building extraordinary capabilities and truly unique competitive advantages. In Spain, I am working towards a bright future for the organisation, one inspired by bespoke players in the market.

NEXU is our first commercial launch providing short term financial solutions for individuals with recurring income but who have occasional challenges to make ends meet. We will also launch other brands as we want to tackle other niches that are actually underserved in Spain.

I am conscious we are in complex times with a global pandemic probably leading to a hard recession. We are taking precautions, we are extremely careful and the team is constantly designing risk models and processes to help us navigate these uncertain times.

|

|---|

| At Nexu.es a successful application is automatically processed and the money is transferred to the customer’s account within minutes, often taking only a few seconds. |

– How did the team look like, when you joined? What did you do to build the team?

– I am lucky to work with Pasi Marjanen and Lauri Lehtonen, they have been by my side since the very beginning. It was last Christmas when I started staffing the project, and I recognise I had to face serious challenges. I assembled an initial team of 6 people to get NEXU live in Spain and we managed to make it into production in 60 days. It was amazing. Two of our team´s highly skilled professionals were provided by Middleware, resulting in seamless and highly productive cooperation.

Up to date, Blue Finance has grown very rapidly, the key to this success has been putting customers first and helping individuals to obtain financial solutions in a simple and accessible way. We are experiencing unprecedented success and we are one of the fastest-growing fintech companies in Europe. This could not have happened without AXON, our architecture platform.

|

|---|

| Lauri Lehtonen, Founder & CEO of Blue Finance |

– How did the company look like in terms of IT-landscape? What challenges did you face? How did you solve them?

– Blue Finance has been very proud of having developed its own infrastructure from 2014 to date. We realised however that to win in an ever-changing environment, with multiple products, process and collection structures, we needed an upgrade.

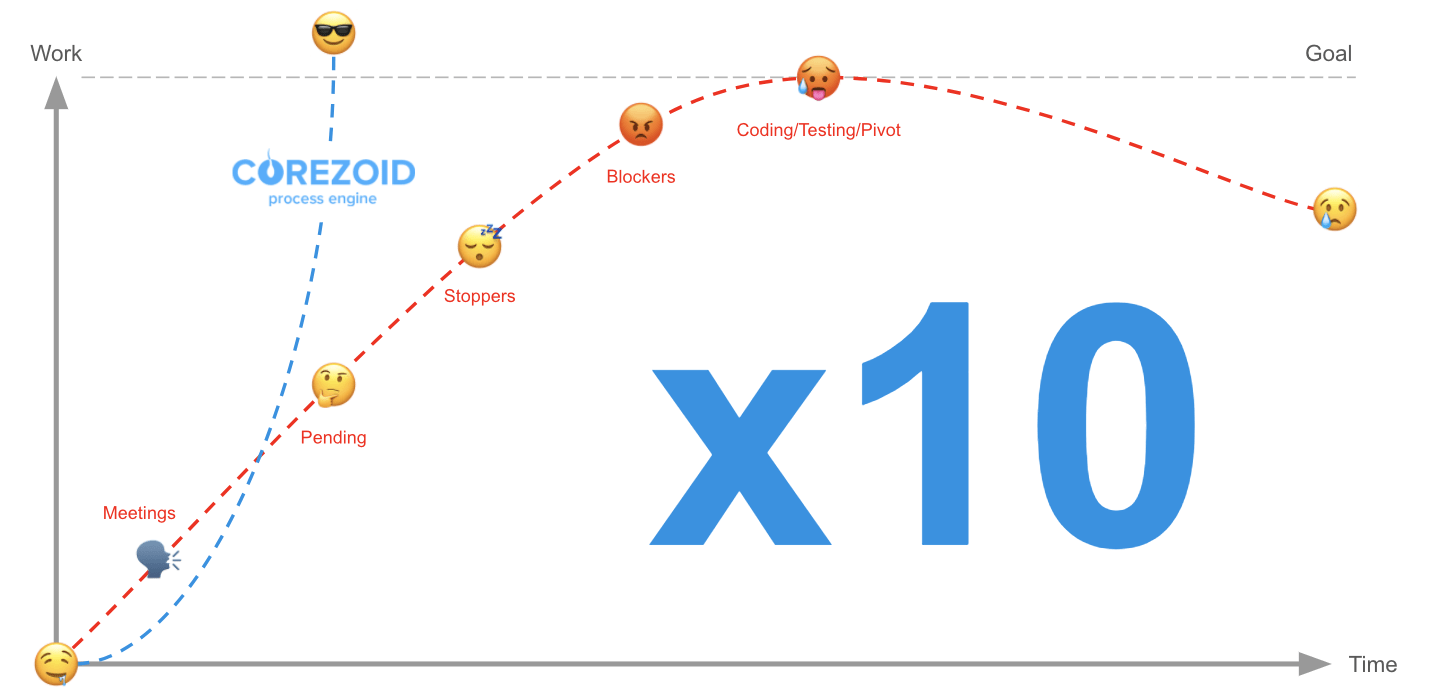

I have been in this vertical now for 10 years and I have realised the same problems all over: a packed IT team with an overwhelming task list who spend most of their time fighting fires, with little time for creativity and development.

We find Corezoid processing power a game-changer on this topic. We have shifted focus from firefighting to improving our automation processes now built on competitive advantages instead. Every two weeks we accomplish releases that would have otherwise needed months of developments and bug-solving. By now we are working toward a fully automated loan processing flow that would have not been reachable only a few months back.

|

|---|

| Corezoid processing power is a game-changer |

– Could you, please, comment on the corporate culture of the company? What are your core values? How do you make sure people follow those values?

– I believe in delegation, I like to hold people accountable thus to foster their creativity and engagement. If you are taking responsibility for what you do, you care about it. Same as if you fuck it up you will fix it. Simple as that. We have a very open culture and flat hierarchy which are highly appreciated; you can see our people growing professionally very rapid. We are very unstructured, and while some find this quite challenging, others love it; they feel like they can contribute more, and they thrive through the challenge.

It’s engaging to see that every day you can bring something new to the team and be part of what is happening around you. Our people are valuable assets to our organisation and I am confident they feel that way too.

– What are your plans for the future both in terms of business and IT-decisions?

– Blue Finance Ibérica will be shaping the fintech of the future and extending its operations internationally. We are already looking into bringing new products to the Spanish market and it's been only 7 weeks since we start up. We are experiencing a very rapid and welcomed penetration which is offsetting our budgeted figures every single week.

On the Technology side, we feel that we have achieved a robust but flexible architecture, the kind of composable banking setting that allows growing in many directions. We will continue working on automation and key competitive processes while keeping integration with state-of-the-art technologies to ensure we stay on top of our game.

– How do you keep yourself fit for business? Do you go for sports? Do you have a hobby?

– Well, my story is one of resilience and hard work. As a small entrepreneur with a few shops in retail stores, I got totally broke and lost everything due to the 2008 crisis. But thanks to running I found myself back on track. I do running ever since, 3-5 Km a day currently, and I always combine my training with kitesurfing or Padel tennis if conditions allow. I think playing sports is important to stay fitted both physically and mentally.

|

|---|

| Padel tennis playground |

– Could you, please, advise us any books\movies worth reading\watching? (fiction or business).

– I read a lot, really. One book I have read already two times this year is “The Antidote”, by Oliver Burkeman. It relies on stoic philosophy, which I find fascinating, and exposes how to fight against negative thinking and reorient your inner dialogue. I highly recommend it, this is a book that can change your life.

|

|---|

| The Antidote: Happiness for People Who Can't Stand Positive Thinking |

One film I enjoyed watching some time ago was “Ex Machina” by Alex Garland. The plot consists of a young programmer who participates in an experiment where he is expected to interact with a robot to test her artificial intelligence innovations. It's a sci-fi film which raises moral dilemmas on the ethics of building artificial conscience.

|

|---|

| EX_Machina movie on IMDB |

– Thanks Julio for the interview! I wish you all the best for your future endeavours.

– Thank you, Sergii.