Blue Finance has launched a state-of-the-art platform offering financial services in Spain using Corezoid

|

|---|

Madrid, April 13, 2020 – Blue Finance Oy (Finland) announced the launch of an online lending service in Spain: Nexu.es.

The service allows users to easily and quickly apply for an online loan and instantly get an answer from NEXU. A successful application is automatically processed and the money is transferred to the customer’s account within minutes, often taking only a few seconds, working 24 hours and 7 days a week without human interaction.

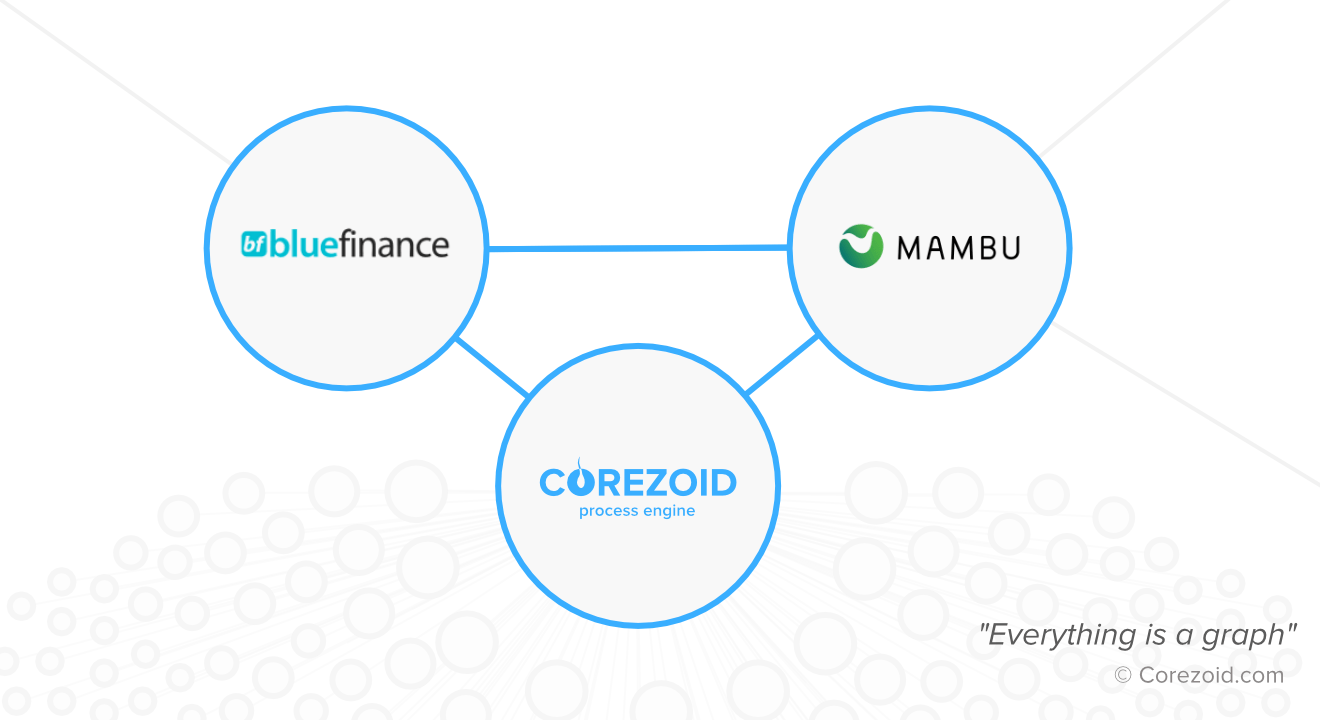

Spain is the first country to use AXON – a lean banking framework by Blue Finance. NEXU lending services have been launched with the help of Blue Finance's technology partner, Middleware Inc. company (USA). The Mambu composable banking cloud-based platform created by Mambu GmbH (Germany) was used as the basis of the technical architecture. The operational processing layer was built on the Mambu Process Orchestrator powered by Corezoid Process Engine.

“As we experience rapid growth across Europe, we realized the need for a more robust, flexible and scalable solution architecture. It was a difficult decision to depart from our legacy system, but we understood that to continue developing Blue Finance as a modern digital platform supporting online lending and gaining a competitive advantage we had to become more efficient in many ways, also technologically. This infrastructure allows us to launch new markets within a few months. It is simply astonishing how little effort it requires both to set up and to keep it running. Three months have passed since we started the project from scratch to the business launch with the first real transaction recorded,” – says Julio Gómez, CEO of Blue Finance Ibérica.

“Blue Finance plans to continue working with Middleware Inc. as a technology partner for the development of the platform not only in Spain, but further in next launches in the EU,” - claims Hannu Kaila, CIO of the Blue Finance group of companies.

“I envision a service with a positive social impact, a helping hand always available, 24/7. Citizens should be able to access credit solutions completely online, anytime, from their homes and on their mobile phones, without barriers. The process should require minimal effort, starting from customer identification to avoid fraudsters and having fully automated customer journey, pretty much like when ordering an UBER cab,” – states Julio Gómez.

Ben Goldin, CTO/CPO of Mambu said: “The online lending market is growing at an astronomical pace, and it is vital for new lenders to increase market speed so they can quickly respond to customer needs and market changes. It is a great privilege to work with Blue Finance as they are building an innovative financial services product. The powerful combination of Mambu's composable banking platform and the Mambu Process Orchestrator positions Blue Finance to provide remarkable customer experience and gain unprecedented speed and agility."

About BlueFinance.

Blue Finance Ibérica is part of Blue Finance Group, a leading FinTech operator in Scandinavia founded in 2011 and specialized in personal loans. Now Blue Finance Group is launching operations in the EU as part of its ambitious international expansion program, with Spain as a benchmark for markets to come.